According to Investopedia, the definition of InsurTech is:

“the use of technology innovations designed to squeeze out savings and efficiency from the current insurance industry model.”

By now I am sure you know that it only takes a few seconds to get a TypTap quote, but how exactly do we utilize InsurTech to make that happen? At TypTap we make sure we don’t cut corners in order to provide quality, dependable, and competitive insurance coverage. And we do it with limited disruption to your life.

Here’s how we do it….

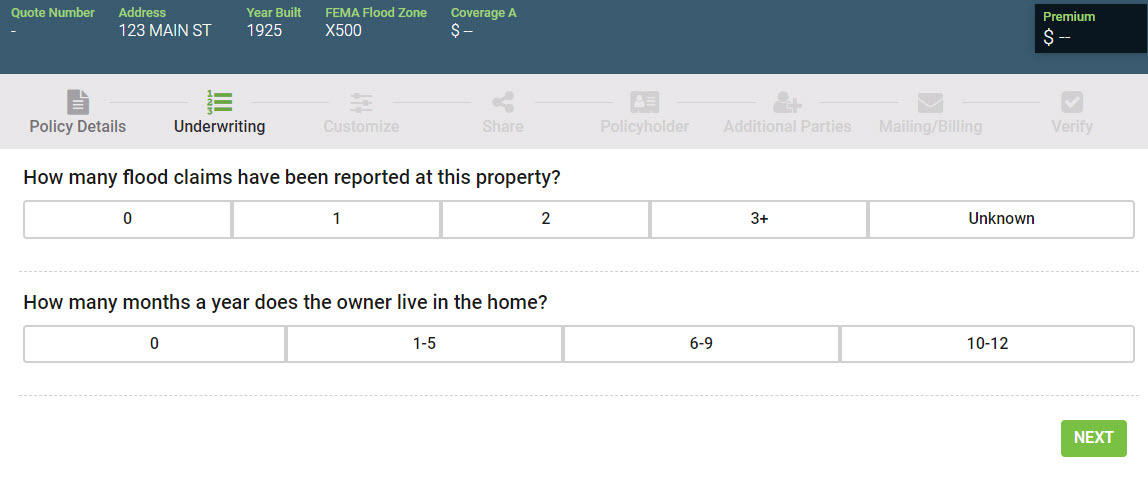

To make an underwriting decision on a property, insurance companies need to know several important pieces of information. The age of home, the number of claims, the type of construction, and current value, just to name a few. Most insurance companies add these questions to their application and ask YOU to fill in the answer. Is your house within 1,000 feet of a fire hydrant? I doubt most of us know the answer to that question off the top of our heads! Answering these questions can take quite a bit of time and energy, so TypTap created a better way.

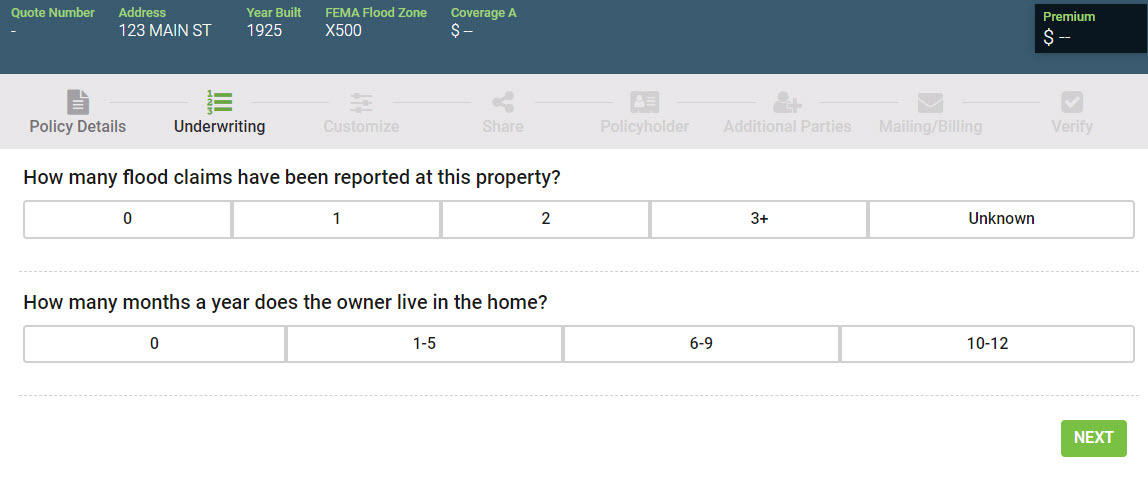

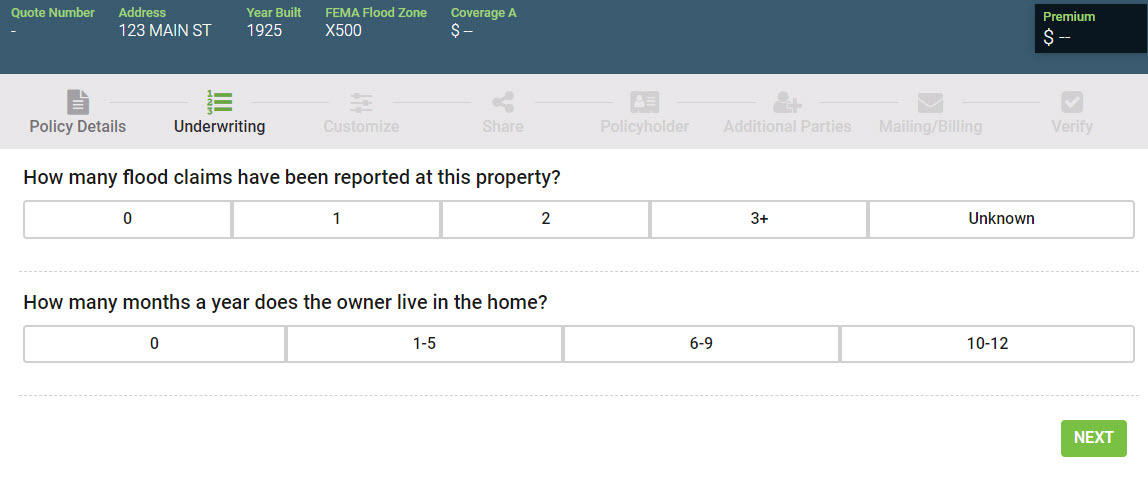

The team at TypTap decided to partner with our sister-company, Exzeo, to create a proprietary database. Doing this allowed us to streamline the quoting and binding process. How many questions do we ask? Below you will find a sample quote:

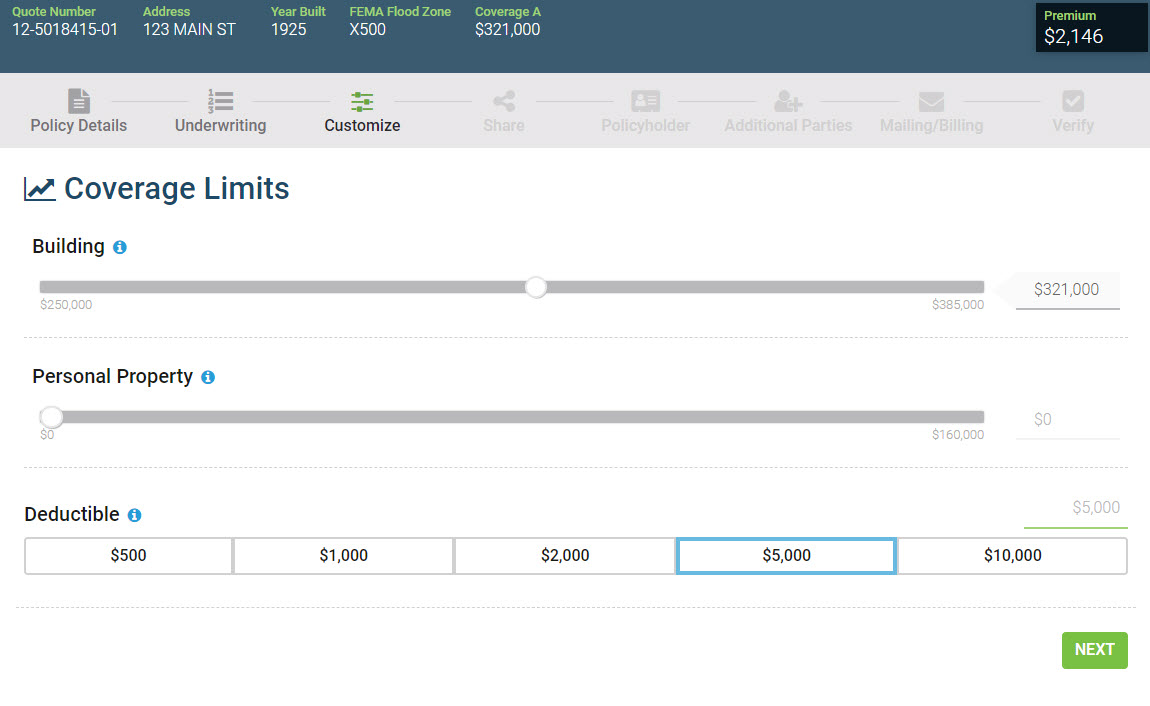

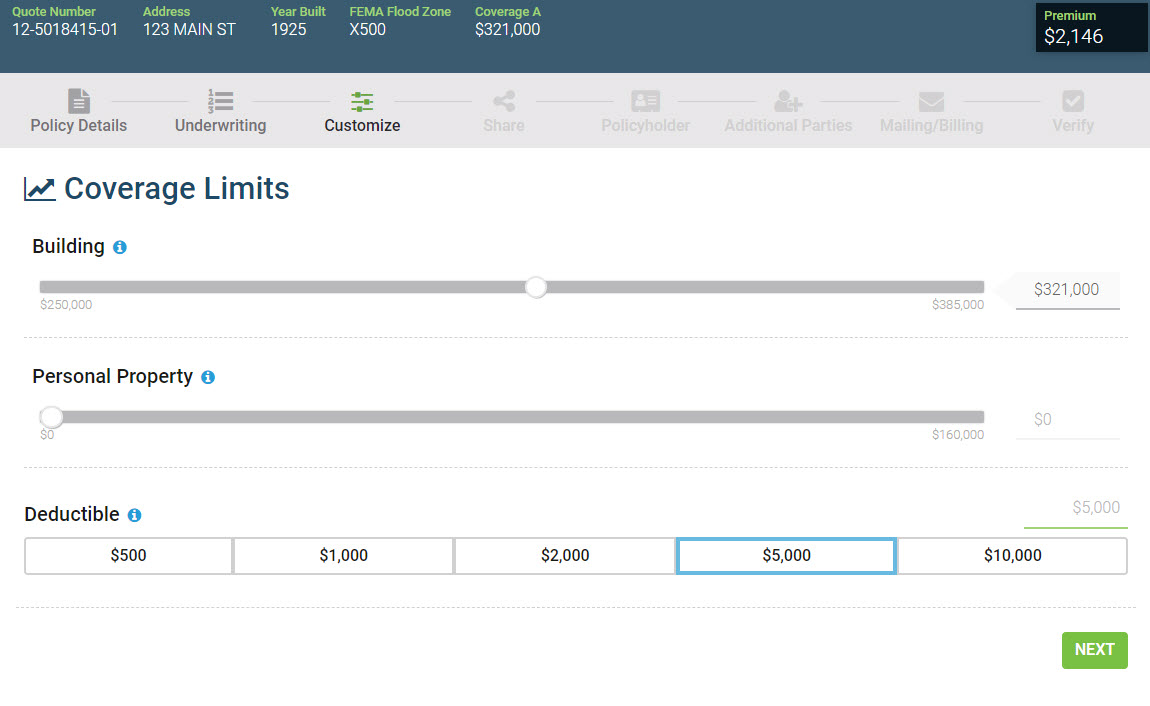

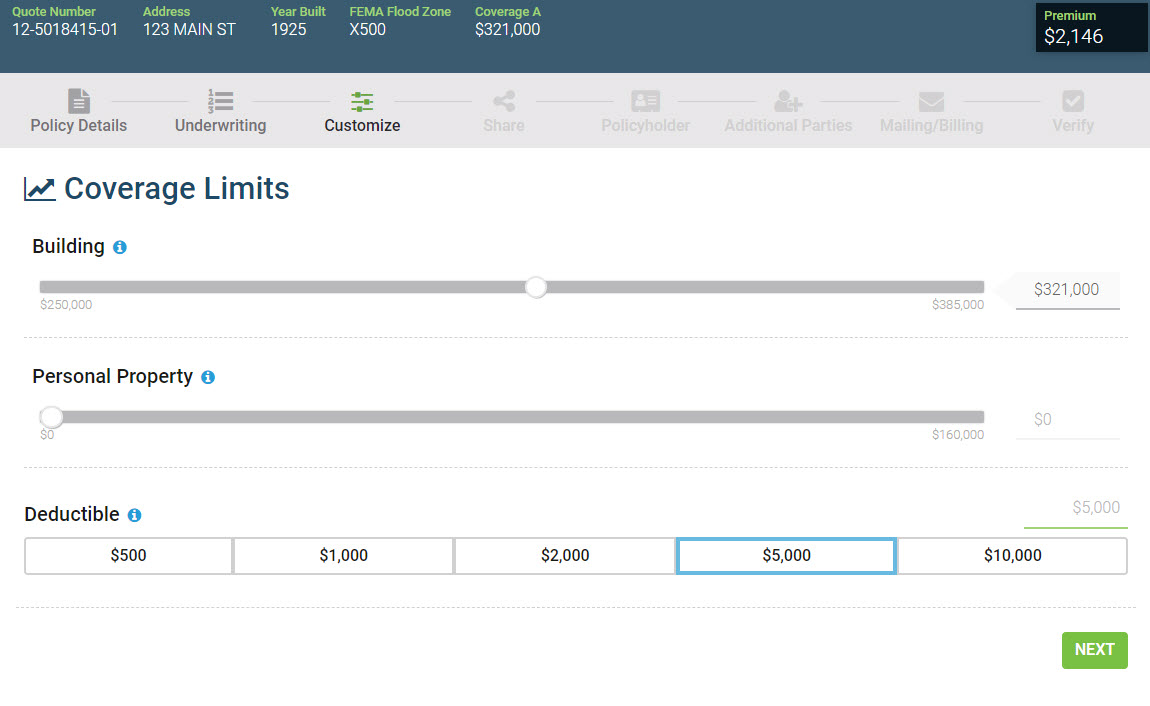

Seriously. It’s just those two questions. Once you select the answers the next page is your quote:

We really mean it when we say a quote in seconds and a policy in minutes. Ready to try it for yourself? Get a quote today at

www.TypTap.com.

Seriously. It’s just those two questions. Once you select the answers the next page is your quote:

Seriously. It’s just those two questions. Once you select the answers the next page is your quote:

We really mean it when we say a quote in seconds and a policy in minutes. Ready to try it for yourself? Get a quote today at www.TypTap.com.

We really mean it when we say a quote in seconds and a policy in minutes. Ready to try it for yourself? Get a quote today at www.TypTap.com.

Seriously. It’s just those two questions. Once you select the answers the next page is your quote:

Seriously. It’s just those two questions. Once you select the answers the next page is your quote:

We really mean it when we say a quote in seconds and a policy in minutes. Ready to try it for yourself? Get a quote today at www.TypTap.com.

We really mean it when we say a quote in seconds and a policy in minutes. Ready to try it for yourself? Get a quote today at www.TypTap.com.